When it comes to financial reporting and decision-making, understanding the concept of a subsequent event is crucial. So, what exactly is a subsequent event and how does it impact businesses? A subsequent event refers to an event or transaction that occurs after the balance sheet date but before the financial statements are issued. These events can significantly influence the financial position and performance of a company, leading to adjustments in the financial statements or even requiring additional disclosure. In this blog, we will delve into the intricacies of subsequent events, explore their implications on financial reporting, and discuss how businesses can navigate through these post-balance sheet date occurrences.

Introduction to Subsequent Events

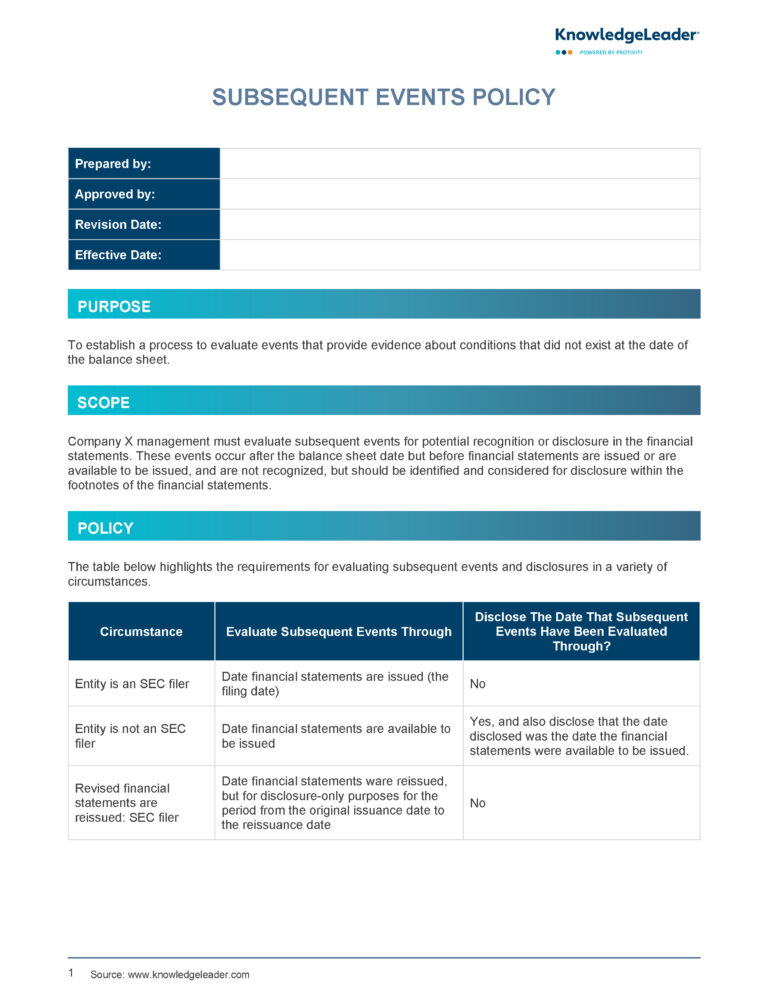

Understanding what is a subsequent event is crucial in the world of finance and accounting. Subsequent events are events or transactions that occur after the end of the reporting period but before the financial statements are issued. These events can have a significant impact on the financial position of a company and need to be carefully evaluated to ensure accurate financial reporting.

Types of Subsequent Events

There are two main types of subsequent events: recognized subsequent events and non-recognized subsequent events. Recognized subsequent events are those that provide additional information about conditions that existed at the end of the reporting period and require adjustments to the financial statements. On the other hand, non-recognized subsequent events are events that provide information about conditions that arose after the reporting period and do not require adjustments but may require disclosure.

Importance of Disclosing Subsequent Events

Disclosing subsequent events is important as it helps provide users of financial statements with the most current information to make informed decisions. Failure to disclose material subsequent events can lead to misleading financial statements and can have legal implications. It is essential for companies to assess the impact of subsequent events on their financial position and performance and disclose them appropriately.

Understanding the Concept

When it comes to financial reporting, understanding what is a subsequent event is crucial for businesses to maintain transparency and compliance. A subsequent event refers to significant occurrences happening after the end of a reporting period but before the financial statements are issued. These events may impact the financial position of a company and thus require disclosure to provide users with updated information.

Types of Subsequent Events

Subsequent events can be categorized into two main types: recognized subsequent events and non-recognized subsequent events. Recognized subsequent events are those that provide further evidence of conditions existing at the end of the reporting period, while non-recognized subsequent events are those that represent new conditions arising after the reporting period.

Importance in Financial Reporting

The concept of subsequent events is crucial as it ensures that financial statements provide relevant and reliable information to users. Disclosing these events can protect stakeholders from making decisions based on outdated information, ultimately fostering trust and transparency within the business environment.

Examples of Subsequent Events

Subsequent events in the business world can have significant impacts on organizations. Let’s delve into some examples of subsequent events that occurred in the year 2022:

Merger or Acquisition

One common subsequent event is a merger or acquisition. For example, in 2022, Company A acquired Company B, resulting in a significant shift in the industry landscape.

Legal Proceedings

Legal matters can also be subsequent events. In 2022, XYZ Inc. faced a lawsuit that impacted its financial standing and reputation.

Natural Disasters

Natural disasters such as hurricanes, earthquakes, or pandemics can be subsequent events affecting businesses. For instance, in 2022, a global pandemic disrupted supply chains worldwide.

Importance of Identifying Subsequent Events

Identifying subsequent events is crucial in financial reporting as it affects the accuracy and reliability of the information presented in financial statements. Companies need to understand what subsequent events are and how they impact their financial position. The disclosure of these events ensures that stakeholders have access to the most current and relevant information for decision-making.

The Impact on Financial Statements

Subsequent events can have a significant impact on a company’s financial statements. For instance, a major event like a natural disaster or a significant lawsuit filed against the company can materially affect its financial position. Proper identification and disclosure of such events are necessary to provide a true and fair view of the company’s financial health.

Regulatory Compliance

Adhering to accounting standards and regulatory requirements is essential in financial reporting. Failure to identify and disclose subsequent events can lead to non-compliance and legal implications. Companies need to stay updated on the latest regulations and ensure that all relevant events are appropriately reported.

:max_bytes(150000):strip_icc()/Earnings-Management_Final-resized-96b44c89123840ca947b565da3cccf74.jpg)

Accounting Treatment of Subsequent Events

Subsequent events in accounting refer to events that occur after the end of the reporting period but before the financial statements are issued. These events may impact the financial position of a company and need to be appropriately reflected in the financial statements.

Recognition of Subsequent Events

Companies need to evaluate subsequent events to determine if they provide additional information about conditions that existed at the end of the reporting period. What is a subsequent event? Subsequent events range from mergers and acquisitions to natural disasters.

Adjusting Events vs Non-Adjusting Events

Adjusting events are those that provide further evidence of conditions existing at the end of the reporting period, while non-adjusting events are indicative of conditions that arose after the reporting period. What is the significance of adjusting vs non-adjusting events? Adjusting events require adjustments to financial statements, while non-adjusting events may need disclosure to provide a complete picture.

Challenges in Dealing with Subsequent Events

When it comes to handling subsequent events, organizations face various challenges that can impact their financial reporting and decision-making processes.

Timeliness of Identification

One of the key challenges is the timely identification of subsequent events. With the fast-paced nature of business environments, detecting these events promptly is crucial.

Assessment of Impact

Assessing the financial and operational impact of subsequent events is another hurdle. Understanding how these events influence the current and future performance of the organization requires thorough analysis.

Disclosure Requirements

Meeting the disclosure requirements for subsequent events adds another layer of complexity. Organizations must adhere to reporting guidelines to ensure transparency and compliance.

Frequently Asked Questions

-

- What is a subsequent event?

- A subsequent event is an event that occurs after the end of the reporting period but before the financial statements are issued. It may require adjustments to the financial statements or disclosure in the footnotes.

-

- Why are subsequent events important?

- Subsequent events are important as they can have a significant impact on the financial position of a company. It is essential to assess and disclose these events to provide users of the financial statements with updated and relevant information.

-

- What are the two types of subsequent events?

- The two types of subsequent events are recognized subsequent events, which require adjustments to the financial statements, and non-recognized subsequent events, which only require disclosure in the footnotes.

Unlocking the Enigma: Decoding Subsequent Events

Subsequent events play a crucial role in financial reporting, as they provide additional information to users of financial statements. Understanding what subsequent events are and how they impact financial statements is essential for investors, analysts, and stakeholders. By delving into the concept of subsequent events, we have uncovered their significance in reflecting the most up-to-date financial position of a company.

In conclusion, a subsequent event is any significant event occurring between the end of the reporting period and the date the financial statements are issued. It can have a material impact on the financial position of a company and requires disclosure in the financial statements. Being aware of subsequent events can help in making informed decisions and assessing the current financial health of an organization.