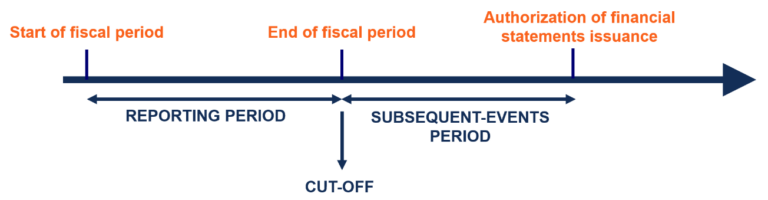

Have you ever come across the term “subsequent events” and wondered what they really are? In the realm of financial reporting and business operations, understanding what are subsequent events is crucial for both companies and stakeholders. These events are occurrences that take place after the end of a reporting period but before the financial statements are issued. They can have a significant impact on the company’s financial position and must be disclosed accordingly. Join us on a journey to unravel the mystery behind subsequent events, their implications, and why they matter in the world of accounting and finance.

Introduction to Subsequent Events

Understanding what subsequent events are is crucial for businesses and investors to stay informed about real-time developments that may impact their decision-making process. Subsequent events refer to occurrences that happen after the closing date of financial statements but may have a significant impact on a company’s financial position.

Importance of Subsequent Events

Identifying and evaluating subsequent events is essential as it allows stakeholders to have the most current information for making informed decisions. These events can range from mergers and acquisitions to natural disasters or regulatory changes, all of which can affect a company’s financial standing.

Types of Subsequent Events

There are two main types of subsequent events: recognized subsequent events and non-recognized subsequent events. Recognized subsequent events are those that provide additional evidence of conditions that existed at the end of the reporting period, while non-recognized subsequent events are those that are indicative of conditions arising after the reporting period.

Importance of Understanding Subsequent Events

When it comes to financial reporting, **understanding subsequent events** is crucial for both businesses and investors. Subsequent events are events that occur after the end of the reporting period but before the financial statements are issued. These events can have a significant impact on the financial health and performance of a company, making it essential to analyze and disclose them properly. By **being aware of what subsequent events entail**, stakeholders can make informed decisions and understand the full picture of a company’s financial standing.

Enhanced Decision Making

Having a clear grasp of subsequent events **empowers decision-making** processes. It allows stakeholders to factor in any **recent developments** that might affect the company’s future prospects. By **being proactive** in understanding and addressing these events, businesses can **mitigate risks and capitalize on opportunities**.

Regulatory Compliance

**Compliance with regulatory requirements** is another reason why understanding subsequent events is vital. Financial reporting standards mandate the disclosure of **relevant subsequent events** to ensure transparency and accuracy in financial statements. Failure to comply with these standards can lead to **penalties** and erode **investor trust**.

Types of Subsequent Events

Subsequent events in the financial world can be categorized into several types, each impacting business operations and financial statements differently. Understanding these types is crucial for businesses to accurately report their financial position.

1. Recognizable Events

Recognizable events are those that provide evidence of conditions that existed at the end of the reporting period, affecting the estimates used in financial reporting. These events require disclosure in the financial statements to inform users of potential changes in the organization’s financial position. It is important to disclose information related to recognizable events with transparency.

2. Non-Recognizable Events

Non-recognizable events are incidents that occur after the reporting period but do not impact the financial statements’ accuracy. While these events may be significant, they are not reflected in the financial reports as they do not affect the reporting period’s results. Non-recognizable events may include events such as lawsuits filed after the reporting period.

Guidelines for Identifying Subsequent Events

Subsequent events are critical to understanding the current state of a business and its potential impact on financial statements. Identifying these events involves several guidelines that businesses must follow to ensure accurate reporting. One key guideline is to assess the timing of the event in relation to the financial statement issuance date.

Assess Timing Relative to Financial Statement Date

It is essential to evaluate whether the subsequent event occurred before or after the financial statements were issued. Events occurring after the statement date may require disclosure or adjustment in the financial reports to reflect the most up-to-date information accurately.

Ensuring the accuracy of the financial statements after the statement date is crucial to maintain transparency in financial reporting.

Evaluate Materiality of the Event

Not all subsequent events have a significant impact on the financial position of a business. Evaluating the materiality of the event is necessary to determine whether it warrants disclosure or adjustment in the financial statements.

- Consider factors such as the magnitude of the event and its potential consequences on the company’s financial health.

- Consult with financial experts to ascertain the material impact of the event on the financial statements.

Case Studies on Subsequent Events

Understanding what subsequent events are is crucial in the financial world. Let’s delve into some insightful case studies to grasp the real-life impact of subsequent events in different scenarios.

Case Study 1: Market Fluctuations

In 2021, Company X experienced significant growth due to a successful product launch, but unforeseen market volatility later impacted its stocks. This highlights how subsequent events can rapidly alter the financial landscape.

Case Study 2: Regulatory Changes

Following regulatory updates in 2021, Company Y had to adjust its operations swiftly to comply with new laws. This case underscores the importance of adapting to external circumstances to thrive amidst uncertainty.

Implications of Subsequent Events on Financial Reporting

Subsequent events refer to significant occurrences that happen after the financial reporting period but before the financial statements are issued. This can include events like mergers, acquisitions, natural disasters, or changes in regulations that may impact a company’s financial position. Understanding and properly disclosing these events are crucial for maintaining transparency and accuracy in financial reporting.

Importance of Disclosure

It is essential for companies to disclose subsequent events as they can have a material impact on the financial statements. Failure to disclose such events may lead to misleading financial information, which can harm investors and stakeholders.

Proper disclosure ensures that users of financial statements have complete information to make informed decisions regarding the company’s financial health and future prospects.

Types of Subsequent Events

Subsequent events are categorized into two types: recognized and non-recognized.

- Recognized events are those that provide evidence of conditions that existed at the end of the reporting period. These events require adjustment to the financial statements.

- Non-recognized events are those that represent new conditions arising after the reporting period. These events do not require adjustments to the financial statements but may require disclosure.

Frequently Asked Questions

-

- What are subsequent events in accounting?

- Subsequent events in accounting are events or transactions that occur after the end of a reporting period, but before the financial statements are issued or available to be issued.

-

- Why are subsequent events important?

- Subsequent events are important because they may have an impact on the financial position of a company after the end of the reporting period, and therefore need to be disclosed in the financial statements to provide users with up-to-date information.

-

- What is the significance of disclosing subsequent events?

- Disclosure of subsequent events is necessary to ensure that financial statements are not misleading and that users have all relevant information to make informed decisions about the company’s financial position and performance.

-

- How are subsequent events classified?

- Subsequent events are typically classified into two categories: 1) Recognized subsequent events that require adjustment to the financial statements, and 2) Non-recognized subsequent events that only require disclosure in the footnotes.

-

- What is the reporting requirement for subsequent events?

- Companies are required to evaluate subsequent events up to the date when the financial statements are issued and disclose the date through which subsequent events have been evaluated.

Unraveling the Mystery: What Are Subsequent Events

After delving into the world of subsequent events, it is clear that they play a crucial role in financial reporting and decision-making. Understanding what subsequent events are and how they impact financial statements is essential for both companies and investors. By analyzing events occurring after the balance sheet date, stakeholders can make informed decisions about the current financial position and future prospects of a company.

In conclusion, subsequent events are dynamic elements that require careful consideration and disclosure. By staying updated on these events, we can anticipate their effects and adapt our strategies accordingly. Remember, the financial landscape is ever-evolving, and being proactive in monitoring subsequent events is key to staying ahead in the game.