When it comes to financial investments like annuities, understanding the tax implications of changing ownership is crucial. The question of whether changing ownership on an annuity constitutes a taxable event is a common one that many annuity holders grapple with. In this blog, we will delve into this topic to provide clarity on the tax implications involved. An annuity can offer a reliable income source for the future, but the tax consequences of transferring ownership should not be overlooked. Join us as we explore the complexities of this issue and shed light on whether changing ownership on an annuity could trigger tax liabilities.

Understanding Annuities

An annuity is a financial product typically offered by insurance companies, designed to provide a steady income stream during retirement. The question, “is changing ownership on an annuity a taxable event?” is crucial for individuals considering alterations to their annuity contracts.

Types of Annuities

There are various types of annuities, including fixed, variable, and indexed annuities. Each type offers different features and benefits, catering to diverse financial goals and risk tolerances.

- Fixed Annuities: Provide a guaranteed income stream.

- Variable Annuities: Offer potential growth tied to investment performance.

- Indexed Annuities: Combine features of both fixed and variable annuities.

Tax Implications of Annuities

When changing ownership on an annuity, it can have tax consequences. The tax treatment varies based on several factors, such as the type of annuity, the ownership change reason, and the timing of the transfer.

One should consider consulting with a financial advisor or tax professional to understand the tax implications specific to their situation in the year 2022.

Ownership Change on Annuities

When considering whether changing ownership on an annuity constitutes a taxable event, it’s essential to understand the implications involved.

Tax Implications

Changing ownership on an annuity can trigger taxable events, depending on the circumstances. If the transfer is between spouses or incident to a divorce proceeding, it may not result in immediate tax consequences.

However, transferring an annuity to another individual or entity may lead to taxable events, such as income tax on growth or even penalties for early withdrawals.

Considerations for Ownership Changes

Before proceeding with an ownership change, it’s crucial to evaluate the potential tax implications and consequences involved.

- Consulting with a financial advisor or tax professional is highly recommended to ensure full understanding of the tax impact.

- Review the terms of the annuity contract to determine any penalties or restrictions associated with ownership changes.

- Be aware of any potential capital gains or income tax obligations that may arise from the transfer.

Tax Implications of Annuity Ownership Transfer

When considering the transfer of annuity ownership, it’s essential to understand the tax implications involved. In most cases, changing ownership on an annuity is not considered a taxable event. However, there are certain scenarios where tax consequences may arise.

Transfer Between Spouses

Transferring an annuity between spouses is generally not taxable. The IRS allows for a tax-free transfer of ownership in cases of divorce or death, where the surviving spouse becomes the new owner.

It’s advisable to consult with a tax professional to ensure proper documentation and reporting to avoid any potential tax liabilities.

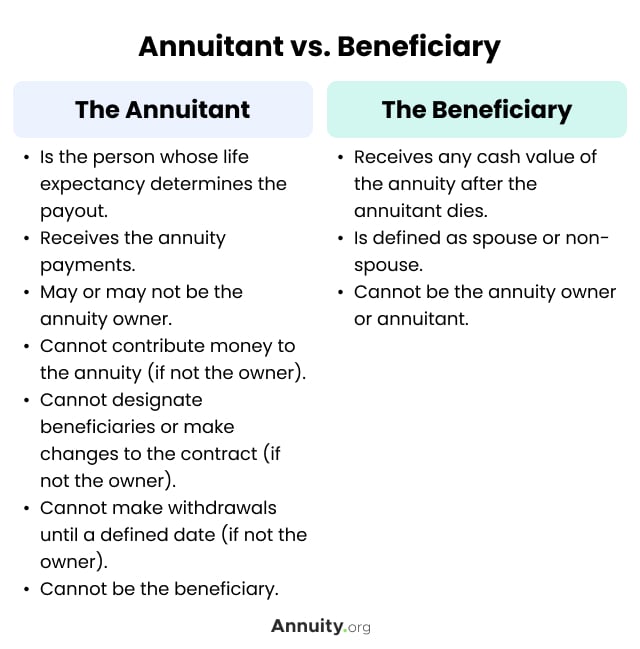

Transfer to a Non-Spouse Beneficiary

When transferring an annuity to a non-spouse beneficiary, tax implications may arise. The beneficiary may be subject to income tax on any gains in the annuity upon withdrawal.

Proper estate planning and understanding the tax consequences can help mitigate any potential tax burdens for the beneficiary.

IRS Regulations on Annuity Ownership Change

When considering a change in ownership of an annuity, it’s essential to understand the IRS regulations to determine if the transfer is a taxable event. Generally, changing ownership on an annuity is not considered a taxable event as long as it meets certain criteria set forth by the IRS.

IRS Guidelines for Non-Taxable Annuity Ownership Changes

According to the IRS, changing ownership on an annuity will not result in taxation if the transfer falls under specific categories:

- Spouse Transfer: Transferring an annuity to a spouse or former spouse as part of a divorce settlement typically does not trigger taxes.

- Death Benefit: In case of the annuity owner’s death, the transfer to a beneficiary as a death benefit is usually not taxable.

IRS Taxable Events for Annuity Ownership Changes

If an annuity ownership change does not meet the IRS guidelines for non-taxable transactions, it could be considered a taxable event. Some instances where taxes may apply include:

- Third-Party Sale: Selling an annuity to a third party may result in taxable gain depending on the circumstances.

- Cash Withdrawal: Withdrawing cash value from an annuity can lead to taxable income if not done correctly.

Steps to Take When Changing Annuity Ownership

When considering changing ownership on an annuity, it’s crucial to understand the implications and steps involved in the process. Below are the essential steps to follow:

Evaluate the Tax Implications (Year YYYY)

Before proceeding with changing annuity ownership, it’s important to consult with a tax advisor to understand the tax ramifications and potential consequences.

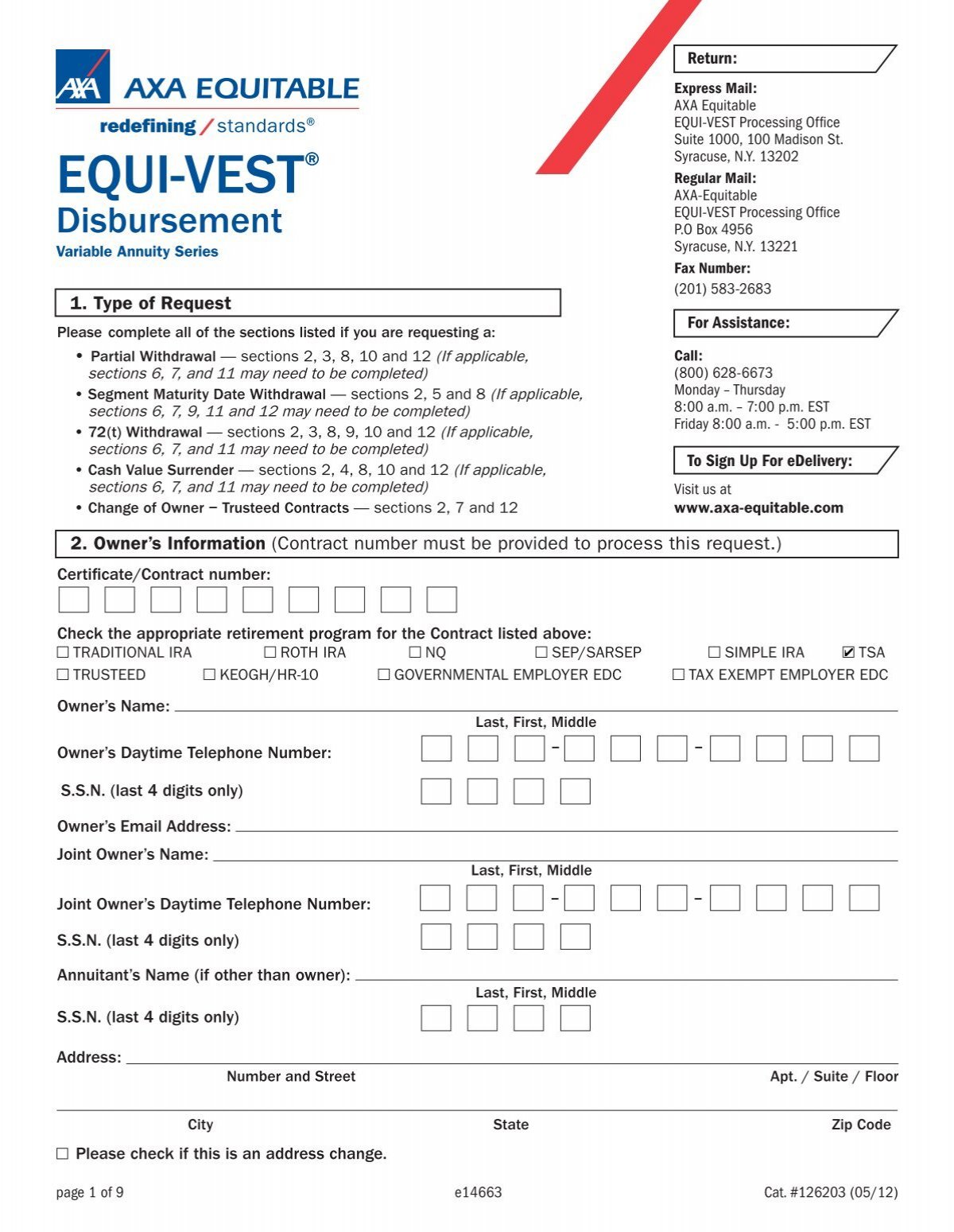

Obtain the Necessary Forms and Documentation

Next, acquire the required forms from the annuity provider that are needed to initiate the ownership change. Ensure to fill out the forms accurately to avoid delays in processing.

Submit the Request to the Annuity Company

Once you have completed the necessary forms, you must submit the request to the annuity company for approval. Ensure all information provided is accurate to expedite the process.

Review the New Ownership Details

After the annuity company processes your request, carefully review the updated ownership details to confirm that all changes have been accurately reflected in the policy.

Consulting a Tax Professional

When considering changing ownership on an annuity, it is crucial to seek guidance from a tax professional to navigate the potential implications and obligations. Consulting a tax professional can provide valuable insights on how such changes may impact your tax situation.

Benefits of Seeking Professional Advice

Tax laws can be complex and subject to change, making it essential to have a professional who stays abreast with the latest regulations guide you through the process.

By seeking professional advice, you can ensure compliance with tax laws, maximize tax efficiency, and potentially avoid costly mistakes that could lead to penalties.

Understanding Tax Implications

Expert tax advice can help you comprehend the tax implications of changing ownership on an annuity, including potential taxable events and strategies to minimize tax liabilities.

- Identifying tax-efficient solutions

- Exploring tax-deferred options

- Optimizing tax benefits

Frequently Asked Questions

-

- What is an annuity?

- An annuity is a financial product sold by insurance companies that provides regular payments to the holder, usually during retirement.

-

- Is changing ownership on an annuity considered a taxable event?

- Changing ownership on an annuity is typically not considered a taxable event if done correctly and following the IRS guidelines.

-

- What are the tax implications of changing ownership on an annuity?

- If ownership is changed properly, there are usually no immediate tax consequences. However, it’s important to consult with a tax advisor or financial planner to ensure compliance with tax laws.

-

- Are there any penalties for changing ownership on an annuity?

- Penalties may apply if the change in ownership triggers a surrender charge or if the new owner is not the spouse of the original owner. It’s important to review the terms of the annuity contract to understand any potential penalties.

-

- How can I avoid tax implications when changing ownership on an annuity?

- To avoid adverse tax implications, it’s recommended to transfer ownership following the IRS guidelines and seek advice from a financial professional.

Final Thoughts: Understanding the Tax Implications of Changing Annuity Ownership

In conclusion, the question “Is changing ownership on an annuity a taxable event?” requires a nuanced understanding of the circumstances involved. While simply changing the ownership of an annuity may not trigger immediate tax consequences, it’s crucial to consider potential implications such as gift tax or income tax down the line.

Consulting with a financial advisor or tax professional before making any changes to annuity ownership is highly recommended to ensure compliance with tax laws and to make informed decisions. Remember that every individual’s situation is unique, and seeking personalized advice can help navigate the complexities of annuity ownership changes.

Overall, staying informed and seeking professional guidance are key to managing your annuity investments effectively and minimizing tax liabilities.